What cost forecasting formula/method do you use at every stage of your project?

Check this video tutorial to learn what performance-based cost forecasting formula (EAC/ETC) is recommended at various stages of your project.

Download the free audio mp3 podcast of this episode on iTunes.

Want more training? Subscribe to Project Control Academy to receive complimentary training videos and resources delivered to your mailbox.

Project Control Quotes to Consider: Join Project Control Academy on Instagram for tons of great quotes.

Video Transcript:

Have you encountered various cost forecasting formulas that gave you different results?

Just like many of you, I came across various cost forecasting methods and formulas. Different clients requested different methods; Different companies used different techniques; different cost control systems used different cost forecasting formulas. In most cases, regardless of the cost forecasting method used, the same formula was used throughout the project lifecycle.

With different results that you get depending on the method used, the question is what cost forecasting formula/method shall you use at every stage of your project. Is there any way that you can validate the viability of your cost forecasts?

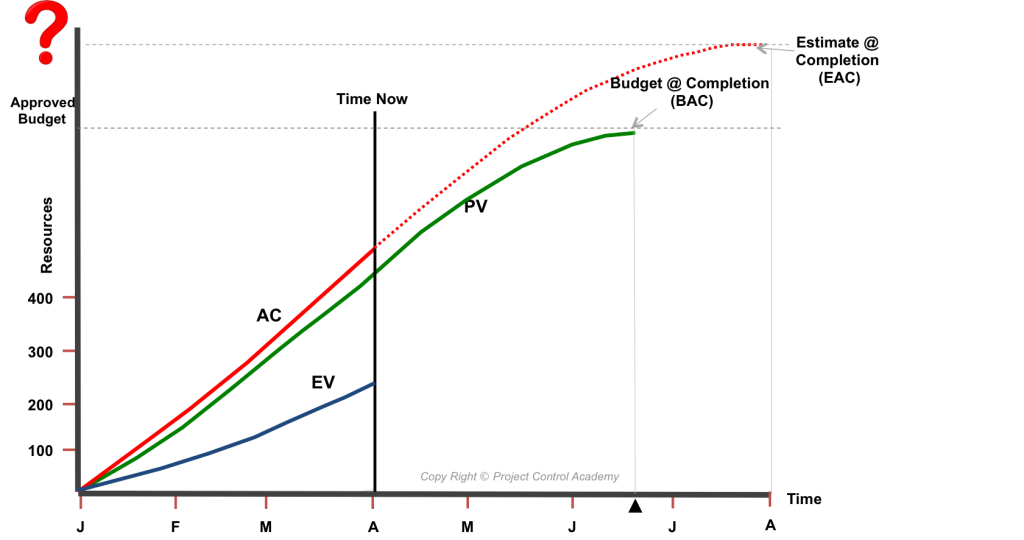

In this post, the EVM forecasting approach to predict the final project cost, given the current project performance, is discussed. I will show you what performance-based cost forecasting formula is recommended at every stage of your project.

The Formula For Performance-Based Cost Forecasting

Which cost forecasting formula do you use to compute the final cost at completion (EAC) or remaining cost (ETC) in your project?

Effective cost forecasting incorporates the impact of projected project performance.

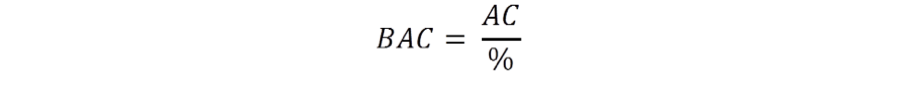

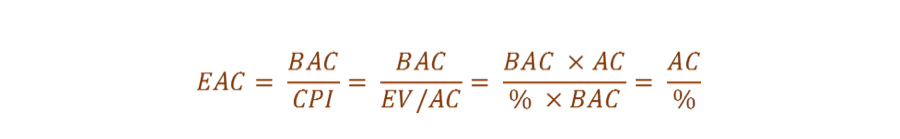

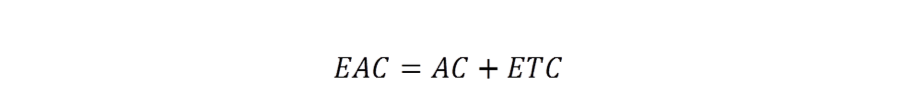

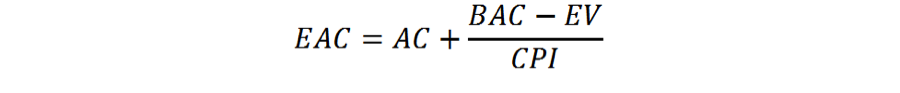

The universal formula for forecasting the final cost at completion (EAC) is:

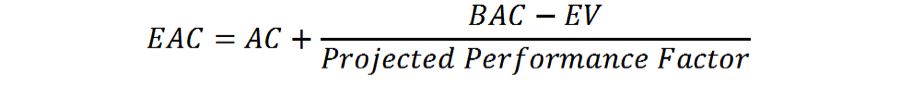

Or

The above formula might seem a bit complicated, but I provided an in-depth understanding of this formula in another video blog post; How to Forecast the Cost at Completion of a Project.

The question is what the “Projected Performance Factor” is. Is it Cost Performance Index (CPI) or something else?

Let’s first evaluate the projected performance factor of CPI:

When Projected Performance Factor is CPI:

When your projected performance factor is equal to your cost performance index, or CPI, then

(If you don’t believe me, just insert the formula for CPI (= EV/AC) on the first equation and do the math. It should drive you to the next equation)

Have you used any of the above formulas as the primary formula for cost forecasting in your projects?

If your answer is yes, did you use it throughout your project life cycle?

A common mistake that most people make is that they stick to one forecasting formula and use it at various stages of the project.

If you use the above formulas, which are the most commonly used formulas for cost forecasting, from the beginning of your project to the end, what would happen?

Is it safe to use this formula at the beginning of your project? How about using it when you don’t have stable performance in your project?

Well, let me give you a real-life example:

In a major project, where accurate forecasting was one of the main objectives of the project, client dictated their forecasting method and in the service agreement as part of the Project Control Plan they requested that all contractors use the following formula for cost forecasting:

Our first reaction was what?! What kind of cost forecasting formula is this?

Our first reaction was what?! What kind of cost forecasting formula is this?

However, after analyzing this formula, we realized that they assumed the performance factor of CPI for the cost forecasting formula. Here is why:

We started using this formula in all cost reports as requested by the client.

We started using this formula in all cost reports as requested by the client.

The problem that we faced was the low performance that we had at the beginning of the project (up to 20% progress) due to the complexity of the work, not having a clear definition of scope and the learning curve.

We kept reporting very low CPI (0.76 in one report) at the beginning of the project. The CPI was dropping one month after another, as we were burning way higher than our earnings. This resulted showing a forecast of $8M (for a $6M project) few months after the project was started.

The client came back and questioned our HIGH forecast. The answer was simple: “that was your formula!”

In the next reporting cycle, we adjusted the forecast by not considering the performance factor (or assuming that future cost performance will be close to 1). This gave us a more accurate forecast.

When we passed the 30% progress stage, we considered performance factor in our calculations, but we didn’t necessarily use CPI as the predicted performance factor.

Considerations for Performance-Based Cost Forecasting

There are two important points that I would like to highlight from the previous example:

1. You may not need to consider the Performance Factor in your cost forecasting formulas at early phases of your project (up to 25-30% overall physical progress).

Do you know why?

The reason is that it takes time, in the beginning, to start claiming progress/ earning, as you need the time to learn more about the project, scope of work, and so on. Furthermore, at the beginning of the project, you normally don’t experience many changes; things are steadier at the beginning. So, it is safe to use the following formula at the early stages of your project:

ETC= BAC- EV

or even

ETC= BAC-AC

2. You shouldn’t use the forecasting formula blindly and keep using the same formula in every reporting cycle. You need to wisely choose your “predicted performance” and adjust your formula accordingly.

Now you might question: “how can I choose the right performance factor for my EAC formula?”

It is a great question.

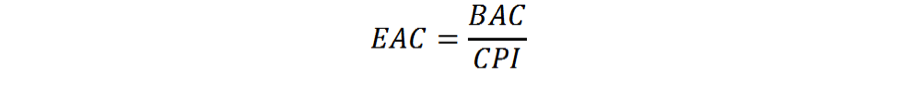

As per PMI Practice Standard for Earned Value Management, your predicted performance factor in the EAC formula is based on your project behavior and the assumptions that you make.

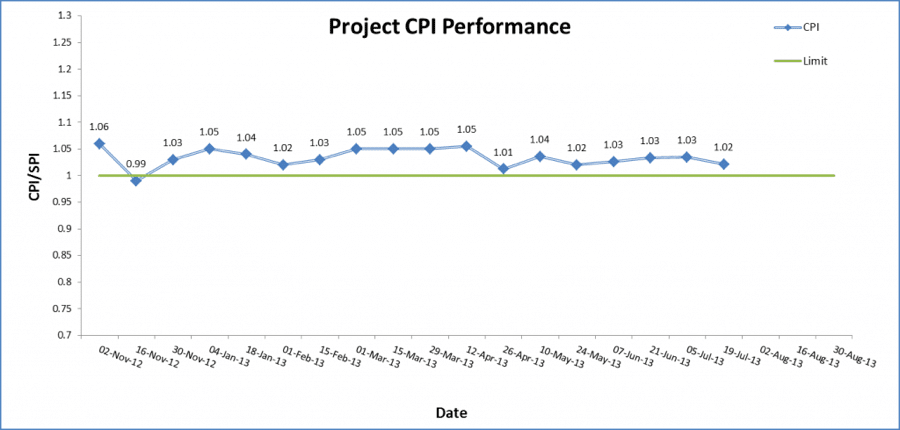

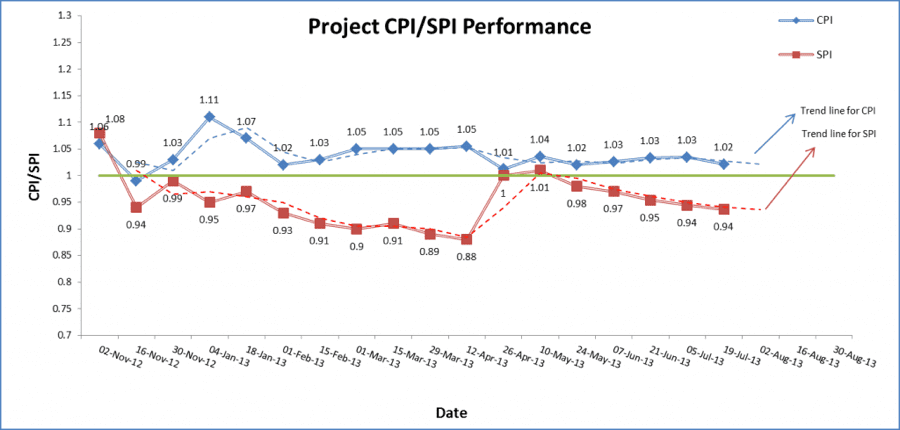

For example, if you can assume that future cost performance will be the same as all past cost performance, you can use cumulative CPI. This is the case when you have small fluctuations in your CPI from one period to another such as the example below:

If your cost performance was more stable in the previous 3 months and you predict that your future performance will be the same as the last three months, then use the average CPI in the last three months.

If you are experiencing delays and your forecast is in correlation with your time extension, then add SPI in your projected performance factor.

As you see, your predicted performance highly depends on your past performance trends. You should do a good performance trend analysis in order to come up with a more accurate forecast.

If your project is not experiencing major changes, one way to predict your performance is by drawing the “trend line” in your CPI/ SPI graphs in Excel.

For example, by using a 2-period moving average trend line in the example below, you can predict the CPI & SPI for the next period. In this example, both CPI and SPI are going to be the same as the last period.

3. Toward the end of the project, the most accurate forecasting method is the manual forecast.

Around 85%-90% progress, when most of the work is completed, the best form of cost estimating is the “manual forecast”; meaning that you come up with a brand new estimate according to the work left to be done.

The bottom line is that Control Account Managers need to evaluate & validate their ETC/ EAC regardless of the Earned Value method used in cost reports!

Now you might question whether there is a way to validate your forecast.

The answer is YES. You can validate the feasibility of your cost forecast by applying a simple yet effective metric, called TCPI. For more details, stay tuned for the next blog post: Evaluating the Accuracy of Your Cost Forecasts.

In Conclusion

The accuracy of your cost forecasts depends on the analysis of the project’s past performance trends and projecting the right performance factor for the remainder of the project. The same formula should NOT be used in every reporting cycle. You need to wisely choose your “predicted performance” at various stages of the project and adjust your forecasts accordingly.

About the Author, Shohreh Ghorbani

Shohreh is a licensed project management professional (PMP) recognized by Project Management Institute (PMI) and holds a Master of Science in Industrial Engineering.

Connect with Shohreh via Facebook, LinkedIn, Instagram, YouTube

![[Free 90-min Masterclass] The Ultimate Leadership Recipe for Project Professionals](https://www.projectcontrolacademy.com/wp-content/uploads/2024/08/4-1024x576.jpg)