Changes are inevitable in construction and in any project. There might be costs that were not budgeted or authorized initially.

A change due to differing site conditions, design errors or omissions, or a scope change due to owner’s added requirements may lead to change orders.

Besides change orders, which are additions to the original contract, there might be other changes resulting in an increase or decrease in costs causing an overrun or underrun of budgeted numbers. Examples are a subcontractor’s bid coming higher than what was budgeted, an over-burn in a general condition item, and an overage of man-hours in site staffing costs.

Any overrun hurts the profitability of a project. It is important to keep track of budget vs. cost variances for controlling costs.

In this post, I introduce you to ‘Anticipated Cost Report’ method and show you how it helps you to track cost variances, make cost forecasts, and manage construction costs. I also walk you through the steps involved in preparing, using, and analyzing the Anticipated Cost Report with sample calculations.

Disclaimer

Terms that I use in this article like ‘Anticipated Cost’, ‘Anticipated Budget’, etc. are more commonly used by many firms and also software companies but I would like to state that these terms may be called differently elsewhere as the industry has not come up with standardized terms.

Anticipated Cost Report (ACR)

Cost control involves keeping a close eye on budgeted numbers, commitments, and anticipated costs which requires preparation of reports with data collected from different sources and members of a project team including estimators, bid managers, project accountants, etc. Reports should capture budget vs. cost variances and offer visibility of exactly how the project is progressing and the project spending is trending.

Though different types of reports are in use, one of the common methods used in construction projects for tracking variances is by creating and analyzing the “Anticipated Cost Report (ACR)”. This method is also known by other names such as “job cost report”, “forecast report”, etc.

In an ACR, estimated budget is allocated to various elements of the project such as Trade contracts, General conditions, Contingency, and so forth. This is usually done by creating budget cost codes using Work Breakdown Structure (WBS), Construction Specifications Institute (CSI) codes, or other customized codes used by a firm, aligning with the firm’s Accounting codes.

Preparing an Anticipated Cost Report (ACR)

Side by side view of the budget and cost figures can be organized in the report for each budget code.

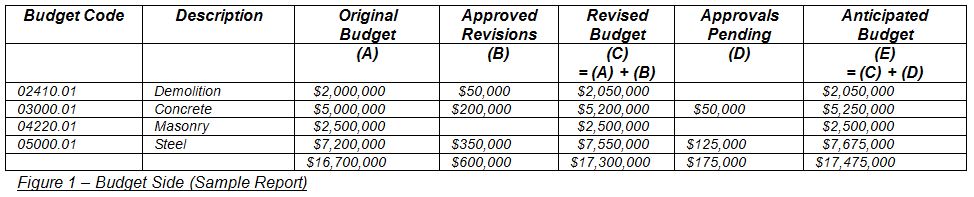

Budget Side

Budget side (Figure 1) should include original budget, approved scope changes or budget transfers , and budgeted cost for pending changes.

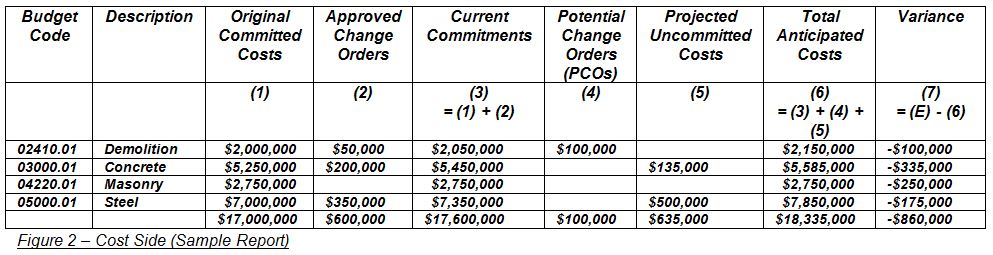

Cost Side

Cost side (Fig 2) should include Trade contract commitments, purchase order values, approved change order values, estimates of potential change orders, and any projected costs. Calculations should indicate budget vs. cost variances (Fig 2, Column 7) and anticipated (forecast) costs (Fig 2, Column 6) for each budget code.

Usually, monthly updates of the project data are used for preparing the report.

Preparing an Anticipated Cost Report allows the:

- Project team to have real-time insight into the project cost information that enables a better evaluation of project cost performance.

- Project manager to have an improved ability for proactively managing forecasted costs.

- Identification and tracking of variances to make informed decisions for controlling costs.

Now let’s review how calculations are performed in the Anticipated Cost Report.

Calculations on an Anticipated Cost Report (ACR)

Budget Calculations:

Revised budget (C) = Original budget (A)+ Approved revisions (B)

Anticipated budget (E) = Revised budget (C) + Approvals pending (D)

Cost Calculations:

Current commitments (3) = Original Committed Costs (1) + Approved Change Orders (2)

Total Anticipated Costs (6) = Current Commitments (3) + Potential Change Orders (4) + Projected Uncommitted Costs (5)

Variance (7) = Anticipated budget (E) – Anticipated cost (7)

Software Programs for Preparing an Anticipated Cost Report (ACR)

There are many software programs available in the market that aid in the preparation of the Anticipated Cost Report (ACR) and analysis of cost metrics. Prolog, Kahua, and Procore are examples of some of the software available in the market.

The above-mentioned software tools help project managers to manage data efficiently, automating calculations, and facilitating data integration with everyone involved in the project.

In a complex project there will be hundreds plus budget codes to track and analyze. Collecting updated and real-time data for both the budget and cost side would be challenging without software. Software vendors include standard reporting formats of the Anticipated Cost Report (ACR). It is also possible to customize reports based on a project or a firm’s requirements.

Change order administration involves creating, approving and issuing documents at different stages. A potential change order may become a change order after owner’s approval. Through built-in digital workflows, software programs can provide all-in-one processing like sending potential change order information and related documents to the owner for initiating the change order, request price proposal from contractor or sub-contractor, and create change order for execution after owner’s approval.

Software programs may facilitate integration of accounting and financial functions. In addition, they may also include modules to create other types of reports such as daily reports, and RFIs (Request for Information).

A reliable software will enable smarter, faster, and effective cost tracking that is essential for cost control and will benefit all project participants, and stake holders involved in the project.

Using Anticipated Cost Report (ACR) for Analysis and Drawing Inferences

Budget Overruns & Under-runs

Periodical monitoring and attention to the underruns and overruns is required to stay on top of changes and variances.

Variance is positive when cost is less than budget and negative when cost is higher.

By analyzing variances for each budget code, project manager may be able to take measures such as adjustments, transfers between budget codes, or consider other alternatives as applicable.

Budget allocated to an item with a positive variance, may be adjusted by moving money to another item or multiple items.

Risk Exposure

Committed costs are expenses that a firm is committed or obligated to pay. This may include awarded contracts, purchase orders, etc. plus any approved change orders.

Any pending costs such as pending change orders and uncommitted costs represent risk exposure.

Depending on whether the owner approves the changes, and negotiates with the contractor, the final anticipated cost may vary.

For effective risk management, it is good to be conservative and include these uncommitted costs in the calculations for projecting the cost forecast of the project.

Allocating Contingency

By looking at the variances, project manager can make decisions about contingency funds by allocating it to budget codes having a negative variance.

Besides using budget and cost data for tracking and analyzing budget vs cost variances, youcan also use the Anticipated Cost Report (ACR) data for the following purposes.

- By looking at the ‘committed costs’ column in the report, you will be able to know the value of commitments to date and use this data for future procurement planning.

- By knowing anticipated costs and invoices, it is possible to project future spends

- By collecting values from the actual performance, it is possible to make use of data intelligence for future projects. For example, the actual unit cost ($/Square foot, $/each, etc.) of a budget code item may be applied for a future estimate. Construction contingency for a future project may be based on the actual percentage of change orders captured from ACR.

There are some differences between the Anticipated Cost Report (ACR) method and the Earned Value Management (EVM).

Comparing ACR with EVM (Earned Value Management)

When the two methods are compared, there are some parallels as well as differences. In both methods, the budget and cost at project completion are calculated and variances are analyzed for cost control purposes. ‘Anticipated Budget’ in the ACR method is the equivalent of Budget at completion (BAC) in the EVM method and ‘Anticipated Cost’ in the ACR method is the equivalent of Estimate at Completion (EAC) in the EVM method.

The difference between the two methods is the way the cost values is calculated. EVM bases the calculation on the progress of work, Earned Value (EV), Actual Cost (AC) to date, the budgeted cost to date, or the Planned Value (PV), to calculate the Cost and schedule Performance, Variances, and Forecasts.

Whereas

ACR uses Actual commitments to date, approved changes, and potential changes to calculate ‘Anticipated Cost’ at project completion without the consideration of the actual physical progress of the work.

The budget at completion (BAC) in the ACR method is calculated based on the approved and pending budget changes to calculate the ‘Anticipated budget’.

There is more visibility of change management in the Anticipated Cost Report (ACR) method.

The necessity of having change management system and including contingency in the projected Planned Value (PV) is well described in the referenced article by Joseph Lukas PE CCE, ‘Earned Value Analysis – Why it does not work’, 2008 AACE International Transactions

In Conclusion:

Owners want to make sure that projects are delivered with no budget overruns. Contractors are interested in bringing some expected profits. Cost tracking is an essential element of cost management and cost controls that assist in accomplishing the owner and contractor goals in any project.

It is important to implement and establish processes for cost tracking. Success of a project depends upon how well cost variances are tracked, analyzed, and managed and how the project follows industry’s best practices.

References

- Carnegie Mellon University, Project Management for Construction

- Cost Tracking for Real Estate Owners

- Joseph Lukas PE CCE, ‘Earned Value Analysis – Why it does not work’, 2008 AACE International Transactions

About the Author, Ramani Sundaram

He has published an article in AACEI’s Cost Engineering Journal and has written many technical articles on the LinkedIn pulse and on other platforms. His prize-winning blog is posted on Project Control Academy’s website.

Ramani is a Board member and Certification Director in AACEI’s NJ section. He is a Certified Cost Professional (CCP), Certified Estimating Professional (CEP), Project Management Professional (PMP) and a Member of RICS (MRICS).

He can be reached at his LinkedIn Profile.

![[Free 90-min Masterclass] The Ultimate Leadership Recipe for Project Professionals](https://www.projectcontrolacademy.com/wp-content/uploads/2024/08/4-1024x576.jpg)