How do you evaluate the accuracy of your cost forecasts?

Watch this video to learn how you can use the TCPI metric to assess the feasibility of your cost forecasts.

Download the free audio mp3 podcast of this episode on iTunes.

Want more training? Subscribe to Project Control Academy to receive complimentary training videos and resources delivered to your mailbox.

Project Control Quotes to Consider: Join Project Control Academy on Instagram for tons of great quotes.

Video Transcript:

How do you evaluate the accuracy of your cost forecasts?

Is there any metric that gives you the confidence on the accuracy of your cost forecasts (EAC/ETC)?

Not long ago, a powerful EVM metric called TCPI (To Complete Performance Index) was introduced as a forecasting metrics. TCPI used primarily to determine if an independent estimate at completion (EAC) is reasonable.

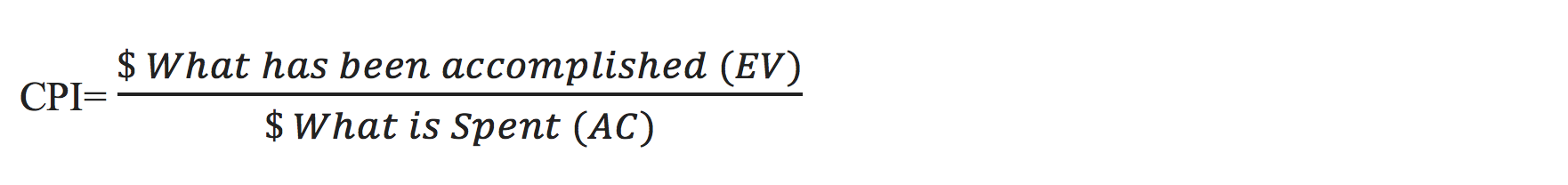

To better understand the power of TCPI in validating the cost forecasts, let’s first understand the TCPI and its difference with the CPI:

The Cost Performance Index (CPI) tells you what has been accomplished for what has already been spent. By contrast, the TCPI focuses on future work. A question such as “what performance levels must be achieved on the remaining work in order to meet a specified management financial goal?” is what is answered with TCPI.

While most practitioners of Earned Value understand the utilization of the CPI, most have rarely used the TCPI. It’s a pity because the TCPI, when used in conjunction with the CPI, provides a powerful set of tools in the management of projects.

TCPI can be used for two main purposes:

- To calculate the future cost performance that a project must achieve on the remainder of the project work to reach a specified end result.

- To determine whether a target EAC is reasonable.

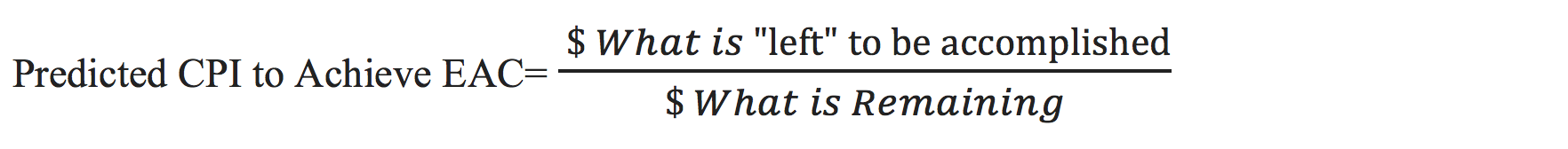

TCPI Gauges The Future CPI Needed To Achieve A Target Forecast (EAC)

Sometimes, your management has an end target in mind (e.g. finishing on budget) and wants you to assess the future cost performance (predicted CPI) to achieve that target. TCPI is the answer to your manager’s question.

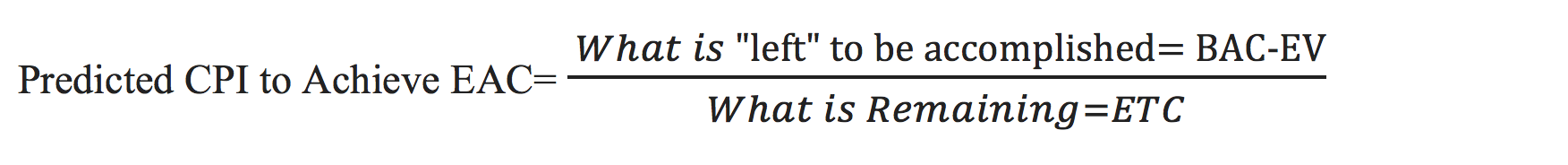

To come up with the TCPI formula, let’s first review the CPI formula:

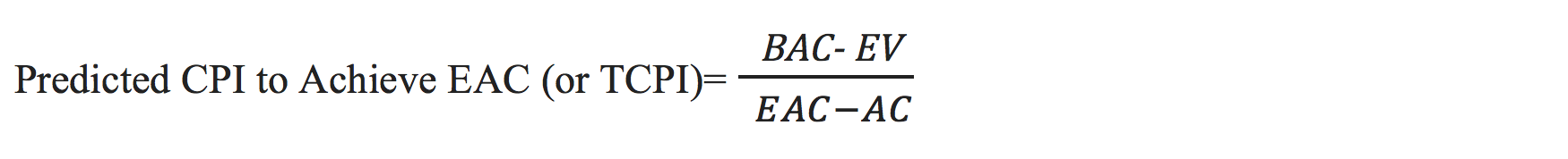

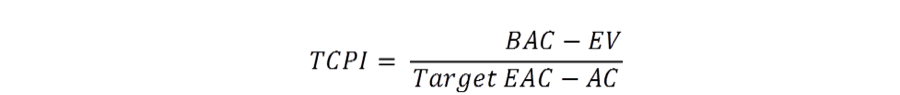

To determine the predicted CPI (or TCPI);

Therefore:

The target EAC could be the current budget at completion (BAC), current estimate at completion (EAC), or even a management specified end result goal.

Given a TCPI of 1.1, the plain language definition is: for every dollar spent from here to the end of the project, a dollar and ten cents worth of budgeted work must be completed or earned, to achieve the target EAC; likewise a TCPI of 0.95 means: for every dollar spent from here to the end of the project, only 95 cents worth of budgeted work must be completed or earned.

If the calculated TCPI results a greater than one outcome, the question that must be answered: “is this new level of cost performance realistically obtainable?” This leads us to the next feature of TCPI: determining the feasibility of a target forecast (EAC)

TCPI Determines The Feasibility of A Target Forecast (EAC)

TCPI determines whether a target EAC is reasonable. How?

Well, TCPI is compared to the cumulative CPI.

- A target EAC is assumed to be reasonable if TCPI is within plus or minus 0.05 of the cumulative CPI.

TCPI= CPIcum + 0.05

- A target EAC is optimistic if TCPI is more than 0.05 higher than the cumulative CPI.

TCPI > CPI cum + 0.05

- A target EAC is conservative if the cumulative CPI is more than 0.05 higher than the TCPI.

TCPI < CPI cum – 0.05

Let’s walk through an example to better understand the use of TCPI:

Example:

Brian is the project manager of a project to create a new software app. The project is due to go live in twelve months.

The project is due to be completed in four months. At the start of the project, Brian estimated that the project would cost $2,400,000. The cost incurred by the project so far is $2,100,000. Brian has also estimated that the value of the work completed so far is $1,200,000.

At a recent meeting with the stakeholder, he was informed that the project must now go live in two months. After the meeting, Brian estimated that the total project would cost $2,900,000.

Brian has approached you to evaluate his forecast. What is your opinion about Brian’s estimated total project cost?

To be able to answer to Brian’s request, you need to first calculate TCPI, right?

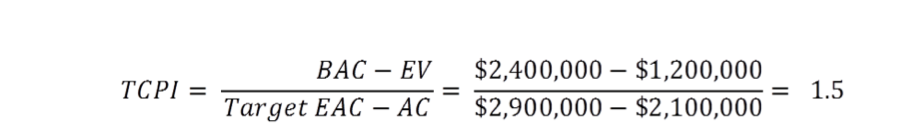

In this project, following are the data you have:

BAC= $2,400,000

AC= $2,100,000

EV= $1,200,000

EAC= $2,900,000

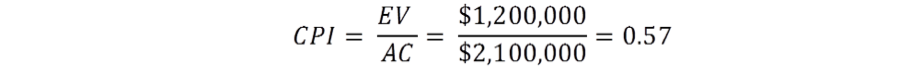

Now, we need to calculate CPI:

To evaluate the feasibility of the forecast, we need to compare TCPI with CPI. In this project, TCPI is greater than CPI+0.05. It means that Brian’s forecast is very optimistic. The chances of finishing the project at $2.9M are very low.

As seen in the example above, TCPI is a very powerful metric that can help you evaluate the accuracy of your forecast.

Please share below whether you have used TCPI in your project reports and analysis.

More Resources:

If you are interested in taking a comprehensive online training on Earned Value Management, check the following EVM training programs:

About the Author, Shohreh Ghorbani

Shohreh is a licensed project management professional (PMP) recognized by Project Management Institute (PMI) and holds a Master of Science in Industrial Engineering.

Connect with Shohreh via Facebook, LinkedIn, Instagram, YouTube

![[Free 90-min Masterclass] The Ultimate Leadership Recipe for Project Professionals](https://www.projectcontrolacademy.com/wp-content/uploads/2024/08/4-1024x576.jpg)